Travel rewards credit history cards0% APR credit rating cardsCash back again credit score cardsBusiness credit cardsAirline credit history cardsHotel credit score cardsStudent credit rating cardsStore charge cards

%, whilst main online modest-organization lenders that do not provide SBA loans have loans with APRs as substantial as ninety nine%.

These measures might make you would like to research and Look at different loan features that may help you choose the most suitable choice that fits your preferences.

Fund your MoneyLion Examining account with An immediate transfer, after which you can use it all over the place you go without any dread of hidden expenses, overdraft fees, or least stability fees!

Checking account guideBest checking accountsBest cost-free examining accountsBest on the internet Check out accountsChecking account options

Empower delivers money improvements, credit rating traces, budgeting instruments and financial institution accounts. Usual funding time for an Empower advance is at some point — speedier than most rivals — and end users will pay An immediate shipping fee to find the funds inside one hour.

To qualify for an SBA loan, lenders commonly want to see a minimum of two decades in small business, powerful yearly earnings and a very good credit rating, which starts all around 690.

Guarding your self versus predatory loans and lenders is important to prevent a credit card debt trap. Down below are a few purple flags you ought to note when obtaining a $twenty five,000 private loan.

See our home acquiring hubGet pre-authorised for the mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs obtain calculatorHow much can I borrow mortgage calculatorInspections and appraisalsMortgage lender testimonials

A $twenty five,000 individual loan is often a significant financial useful resource that opens up a myriad of options. No matter if 25 loans you're looking to create a substantial financial investment in the long term or tackle rapid needs, this loan amount can offer you the economical adaptability you require.

To apply for a loan, however, You'll have to be a member, which could contain a membership cost or distinct eligibility requirements. Furthermore, credit history unions are usually more compact and should not provide exactly the same breadth of products and services as much larger banking institutions or on line lenders.

These disclosures will depth when a really hard pull could manifest, in conjunction with other terms and conditions of your respective preferred Supplier's and/or top lender's products and services.

Whether you prioritize a reduced curiosity fee, a longer repayment phrase, or added capabilities like payment adaptability, make sure the loan give you select matches your exceptional problem.

Get your totally free credit history scoreYour credit score reportUnderstanding your credit scoreUsing your creditImproving your creditProtecting your credit score

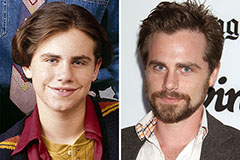

Rider Strong Then & Now!

Rider Strong Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!